Market Momentum: Riding the Waves of Volatility

In the fast-paced world of day trading, understanding and capitalizing on market momentum can be the key to success. This article explores effective strategies for identifying and trading volatile trends, helping you harness the power of market dynamics.

Understanding Market Momentum

Market momentum is the force behind price movements, often driven by investor sentiment, news events, and technical factors. Recognizing these forces can give traders a significant edge in volatile markets.

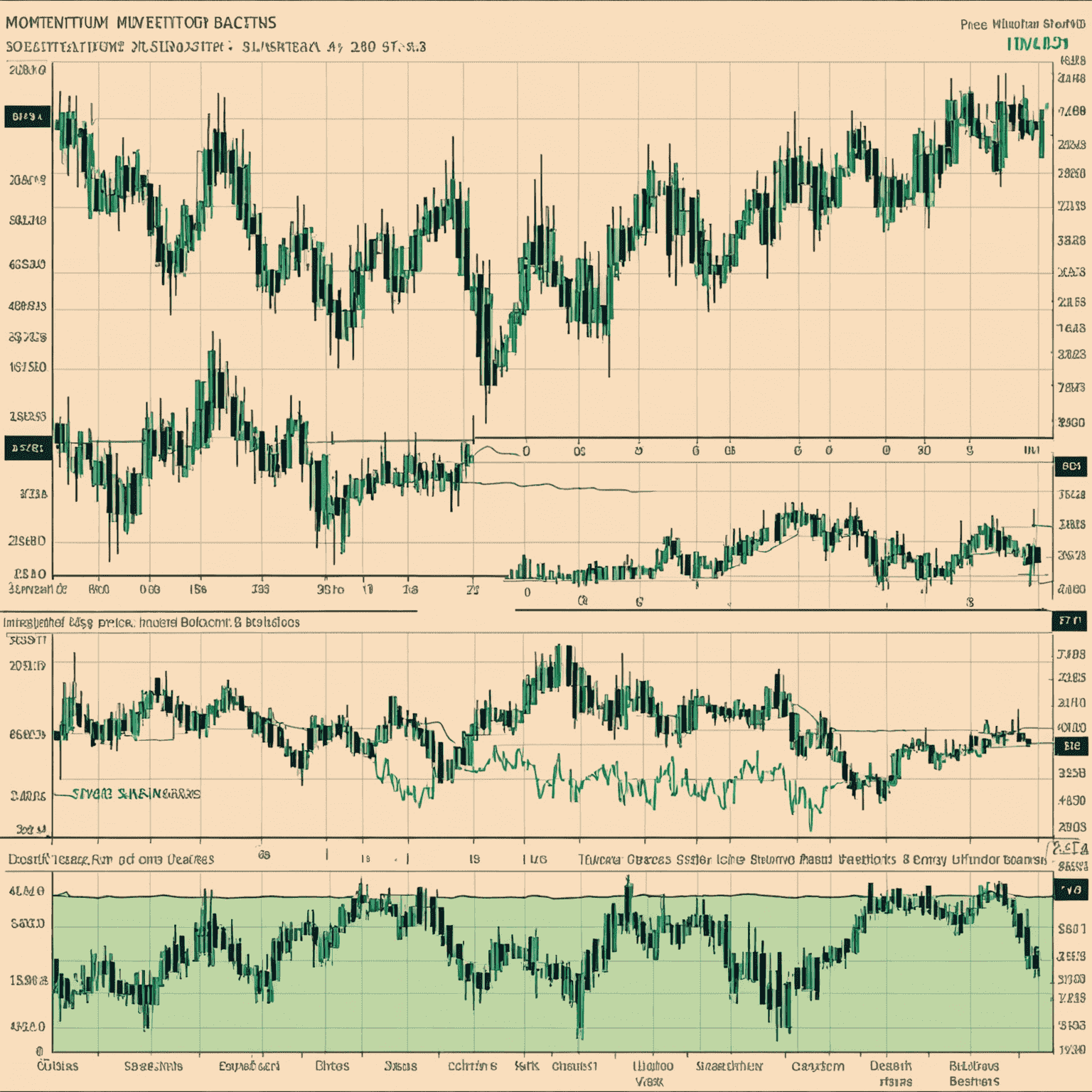

Key Indicators for Momentum Trading:

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Volume-Weighted Average Price (VWAP)

- Bollinger Bands

Strategies for Volatile Markets

Volatile markets can be both a blessing and a curse for traders. Here are some strategies to help you navigate and profit from market turbulence:

- Trend Following: Identify strong trends and ride them for maximum profit potential.

- Breakout Trading: Capitalize on sudden price movements as they break through key levels.

- Mean Reversion: Trade on the assumption that prices will return to their average over time.

- Scalping: Make numerous small profits on minor price changes throughout the day.

Risk Management in Volatile Markets

While volatile markets offer great opportunities, they also come with increased risk. Implementing robust risk management is crucial:

- Set strict stop-loss orders

- Use position sizing techniques

- Diversify your trading strategies

- Stay informed about market-moving events

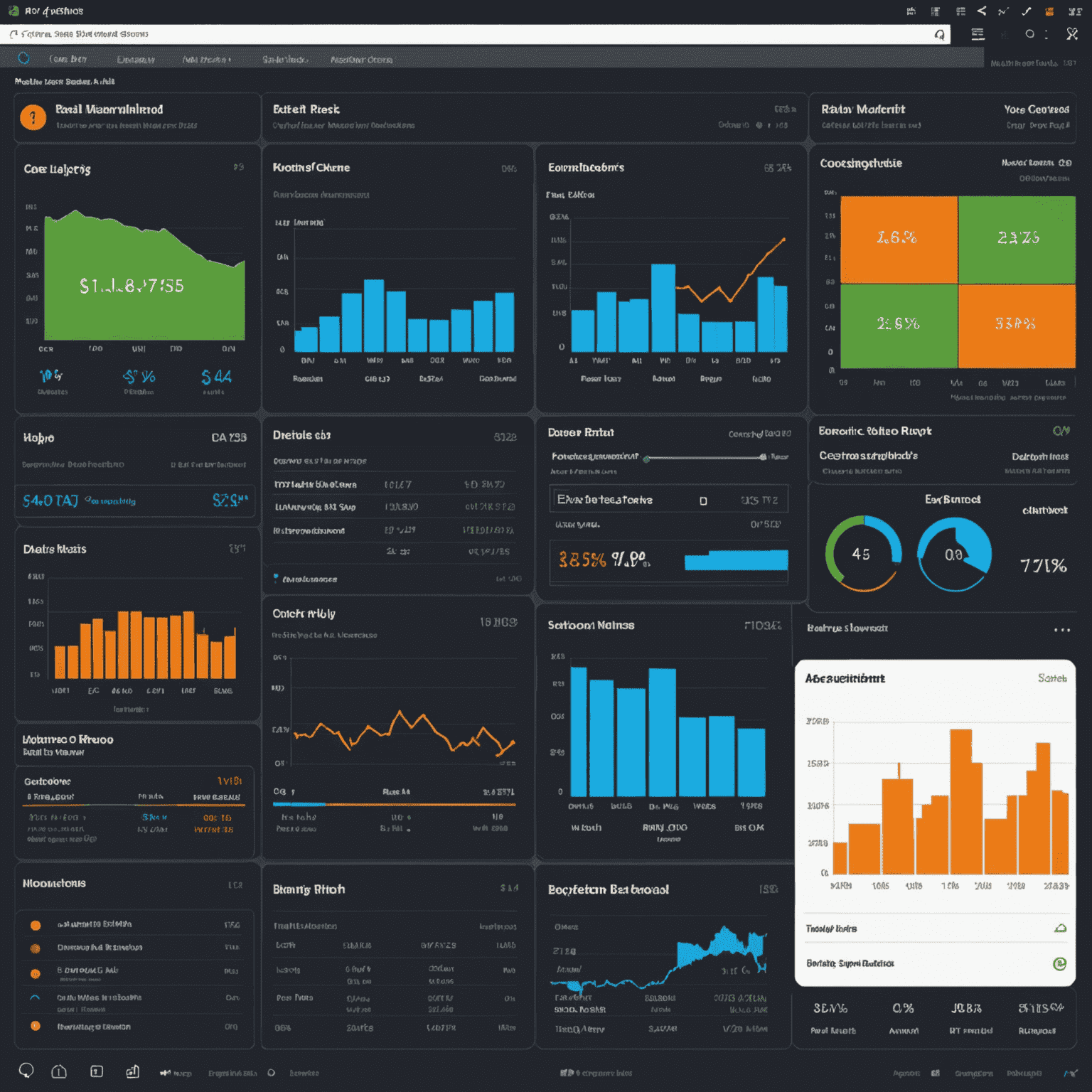

Leveraging Technology for Momentum Trading

In today's digital age, technology plays a crucial role in successful momentum trading. Platforms like SaxoPlatform offer advanced tools that can give you an edge:

- Real-time data feeds

- Advanced charting capabilities

- Automated trading algorithms

- Risk analysis tools

By mastering these strategies and leveraging cutting-edge technology, you can effectively ride the waves of market volatility and capitalize on momentum. Remember, successful trading requires continuous learning and adaptation to ever-changing market conditions.